Warehouses are extremely complex environments, requiring a plethora of different hardware and software solutions to orchestrate various workflows and activities. Historically, almost all warehouses used paper-based methods of assigning orders and tracking inventory. However, towards the end of the 20th century, we saw the introduction of Warehouse Management Systems (WMS), a computational approach to tracking inventory and managing orders.

Key Takeaways:

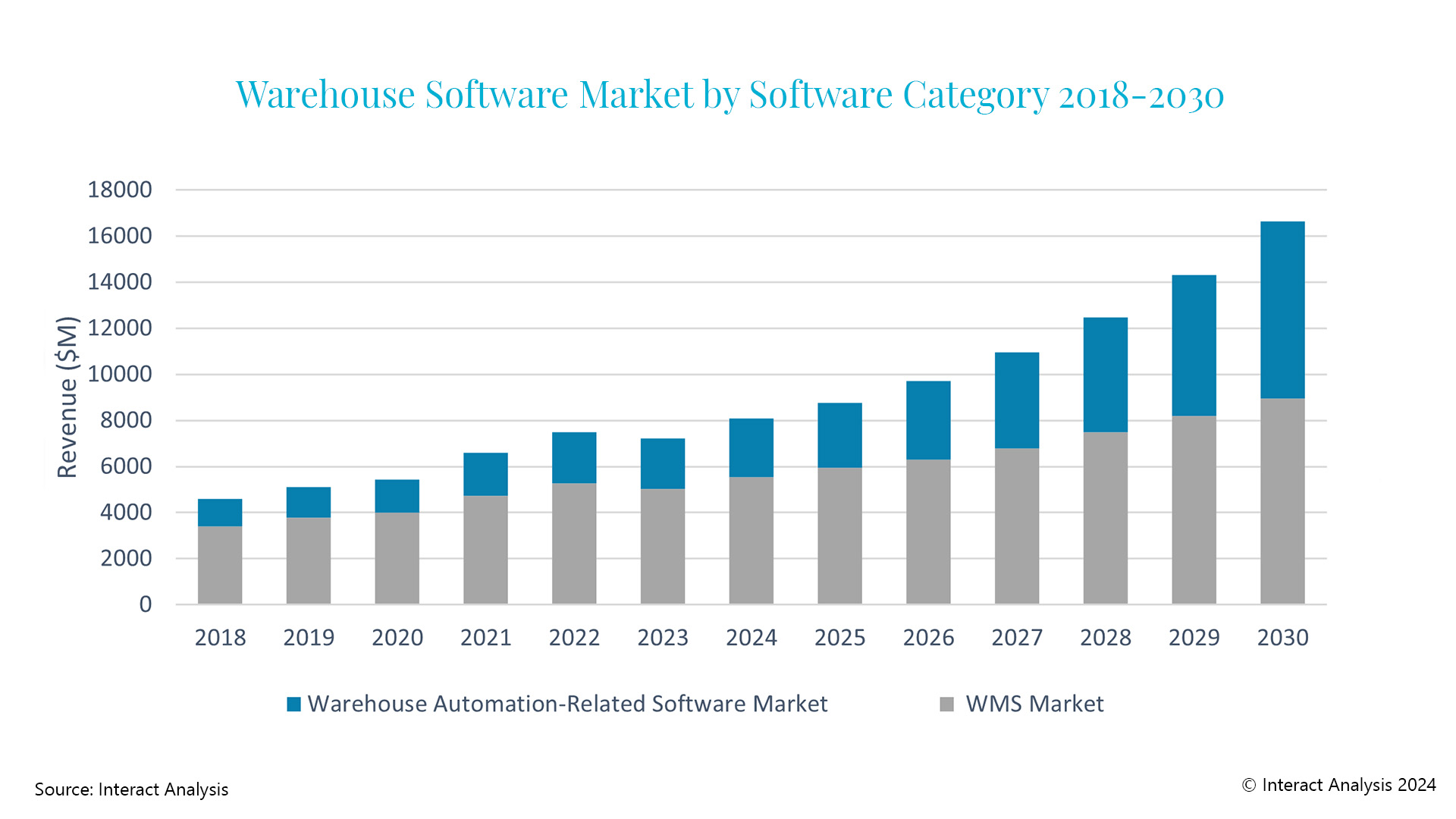

The warehouse software market reached a value of $7.2 billion in 2023, and is expected to grow to $16.6 billion by 2030.

In 2023, the warehouse automation-related software market accounted for 31% of the total warehouse software market, while warehouse management software made up 69%. We anticipate that warehouse automation-related software will increase its market share to 46% by the end of 2030, with warehouse management software expected to decrease to 54%.

The trend towards warehouse automation is reshaping the warehouse software market, including the consolidation of solutions and the blurring of lines between warehouse software providers.

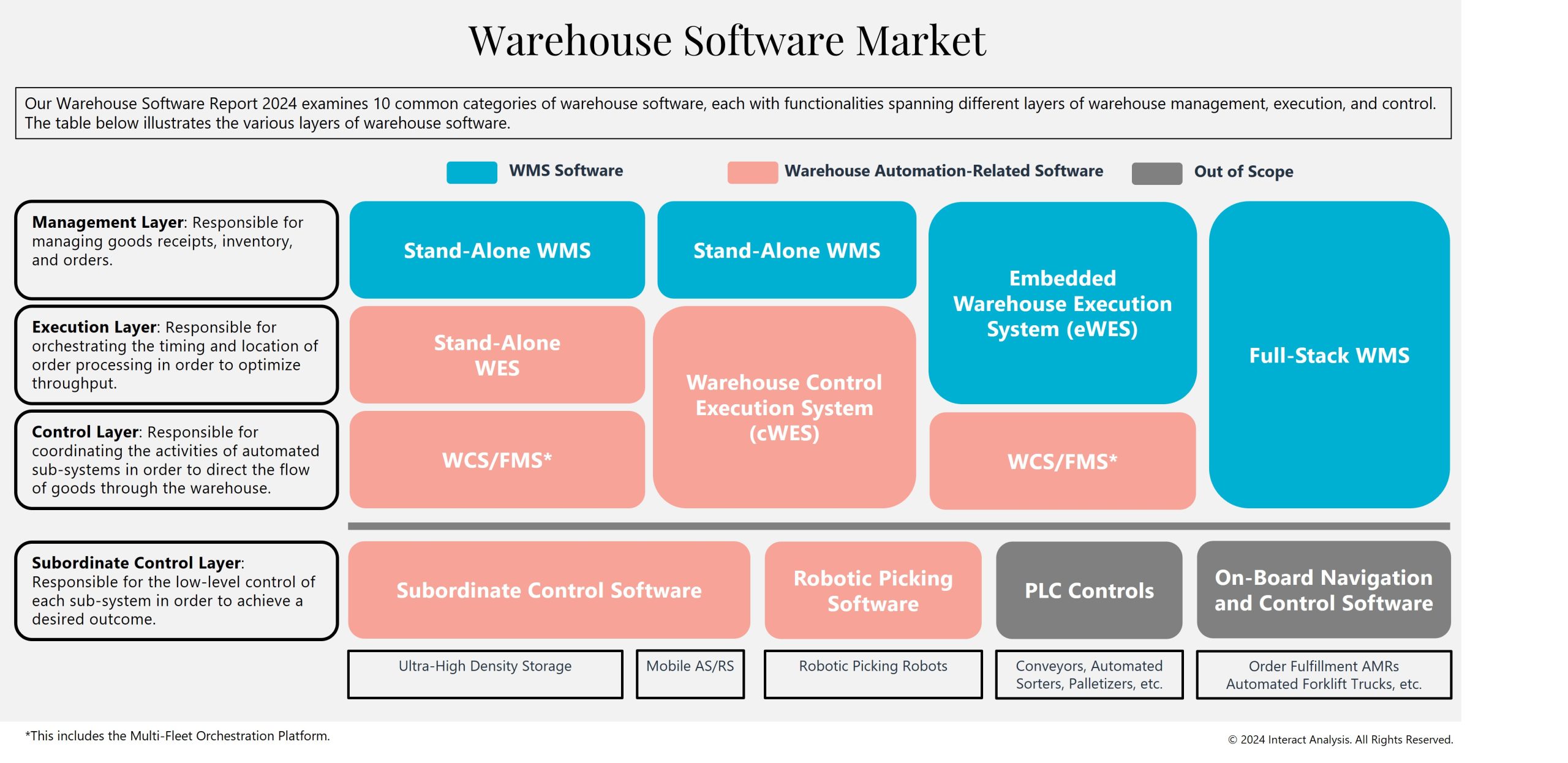

More recently, we’ve seen the introduction of hardware solutions like automation and robotics which have further streamlined warehouse operations. These hardware solutions require additional software, on top of the WMS, to coordinate the movements of the mechatronics and robotics.

Sub-ordinate control software is used to control fine movements of the hardware, while Warehouse Control Systems (WCS) and Fleet Management Systems (FMS) provide the movement logic that enables pallets, cases, totes, and other handling units to get from point A to point B through an automated system. Execution software, on the other hand, is used to orchestrate order release and task allocation to optimize a given output (e.g. maximize throughput or minimize cost).

Our Warehouse Software – 2024 report is the first study to look at both WMS and automation-related software through the same lens. Given the relative maturity of the WMS market, we’re seeing revenue generated from automation-related software solutions growing at a faster rate than warehouse management software. Furthermore, the growth of automation is leading to the blurring of traditional industry boundaries, which is going to lead to significant disruption in the industry over the coming years.

The market for warehouse software reached $7.2 billion in 2023 and is forecast to increase to $16.6 billion by 2030, growing at a CAGR of 13%. As the complexity of warehouses continues to increase, and the need to fine-tune logistical processes grows, we’re expecting significant growth in the deployment of warehouse software solutions.

Breaking the market up into WMS and automation-related software solutions, we find that the market size for WMS-related solutions reached $5 billion in 2023 and is expected to reach $8.9 billion by 2030, growing at a CAGR of 8.6%. Automation-related software solutions, on the other hand, reached $2.2 billion in 2023, with the market anticipated to expand to $7.7 billion by 2030, growing at a much higher rate of 19.5%.

The reason for the differential in growth between WMS-related and automation-related software solutions is that most warehouses have a WMS and growth potential is therefore largely limited to renewals and greenfield warehouse developments. On the other hand, the penetration of automation within warehouses is much lower, resulting in a greater opportunity to automate existing brownfield sites.

The blurring of industry boundaries

The development of warehouse automation is also blurring the lines between what were previously well-defined product categories. Traditionally, warehouse management software was typically provided by enterprise resource planning (ERP) or supply chain vendors. However, with the development of warehouse automation, some warehouse automation solution providers have begun offering warehouse management software, such as Knapp’s Kisoft, Swisslog’s SynQ, and SSI Schaefer’s WAMAS.

Similarly, traditional warehouse management system providers, like Manhattan Associates and Blue Yonder, are getting more involved in the orchestration of automation through the development of execution layers that are embedded into their WMS platforms. Some software providers like SAP and Mantis are going as far as providing a warehouse control system (WCS), where the WMS is then able to connect directly to the PLCs.

In other words, automation vendors are looking to move up the value chain by providing more execution and management products, while traditional software providers are looking to move down into the orchestration space through the development of execution layers that are embedded into their WMS solutions.

Final thoughts

With the growth of the automation market, we’re seeing traditional software providers looking to capture a slice of the pie. However, we’re also seeing that different software providers are developing different strategies to capitalize on the growth of automation.

Some software providers are relying on third-party interoperability layers to help connect and integrate with automation, such as SVT Robotics. Others are developing an in-house library of APIs that are used to connect directly to robotic solutions. Manhattan Associates, on the other hand, isn’t looking to connect directly to automation, but is looking to orchestrate and execute automation through the WES module in its Active platform.

Our research is looking to track and analyze these different strategies, while benchmarking the relative performance of each approach. Given the changes the industry is facing, it’s more important than ever to stay ahead of the curve and develop a successful automation strategy.

Irene Zhang, Senior Analyst

Irene joined Interact Analysis in 2022 as a Senior Analyst in the warehouse automation research area. She has 9 years of experience in global market research. Before joining Interact Analysis, Irene worked for an international PE firm, focusing on semiconductor industry investments and mergers & acquisitions. She holds a master’s degree in applied economics and is based in our UK office.

Rueben Scriven, Research Manager

Rueben is one of the warehouse automation industry’s leading analysts and is a regular speaker at leading industry events. He has moderated several panel discussions on the topic of commercial vehicle electrification and has also appeared on CNBC, providing insight on the global electric bus market.