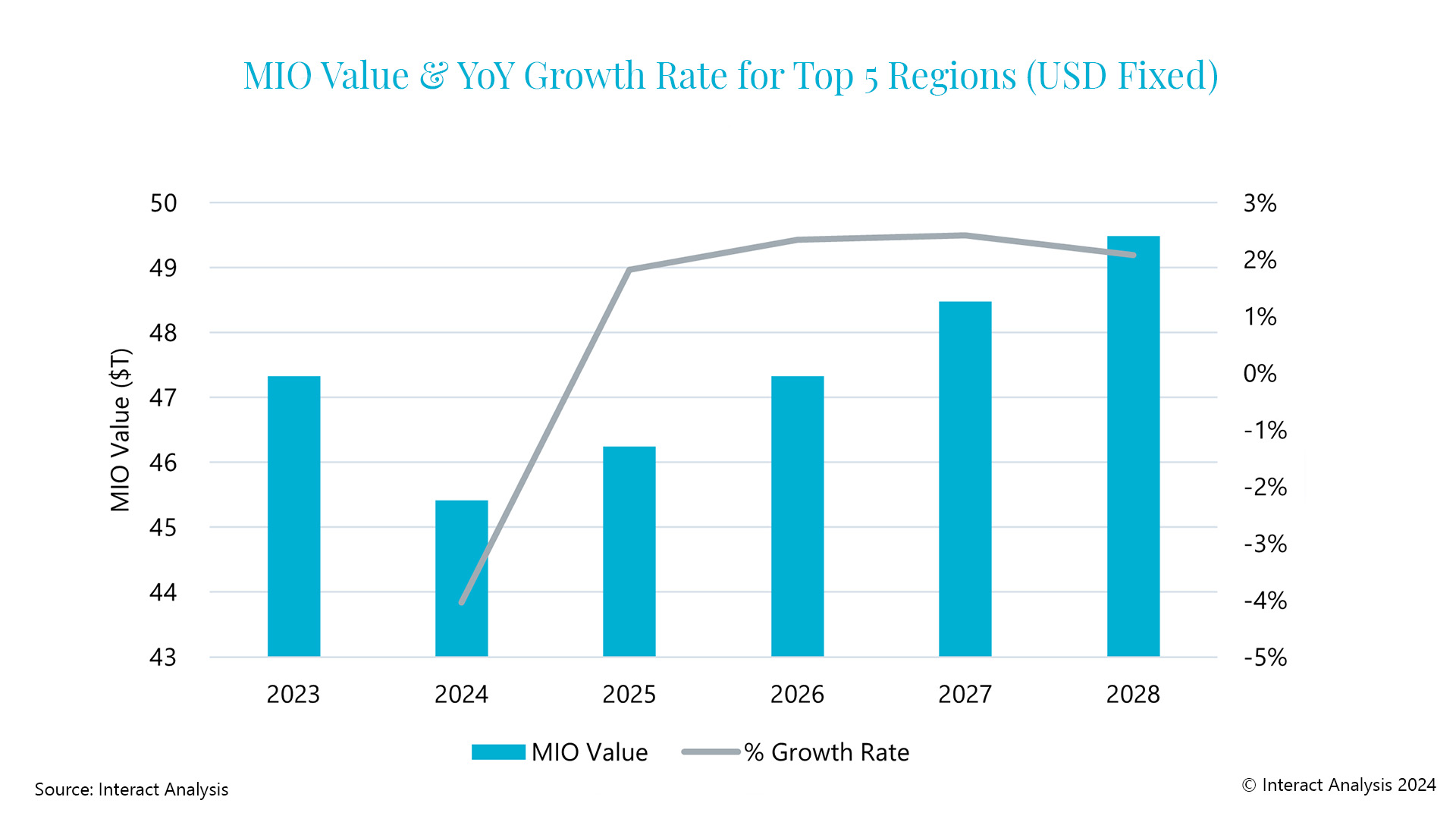

The overall outlook for global manufacturing is challenging for this year, with many companies reporting a decline in orders and most regions expected to see a contraction. However, there are some positive signs on the horizon, particularly in the US, and many territories will end the year in a slightly better position than expected, according to results from our latest Manufacturing Industry Output (MIO) Tracker.

This is not to say that 2024 won’t still mark a difficult year for global manufacturing, with conditions likely to be slightly worse for China than originally anticipated, and a particularly tough 12 months for the manufacturing machinery segment. Continued caution around spending means many companies are choosing to “wait and see” when it comes to investment in equipment and it is still unclear when manufacturing machinery order books will start to recover.

Data and reports still point to a “strong-ish” recovery in 2025

Now that we have greater visibility of how 2024 will pan out, in the wake of numerous industry trade shows and discussions with executives, we have revised our forecasts to reflect this. Our prediction for a soft 2024 for global manufacturing followed by a “strong-ish” recovery next year is mostly holding. The message we received from trade shows is that order books are shrinking, but we forecast an upturn in manufacturing activity towards the end of this year or into the beginning of 2025, leaving many territories in a better-than-expected position. However, until there is a recovery, it is difficult to judge how strong or sustained it will be.

Although we predict a recovery will take place during 2025, it is not immediately clear where this will come from and we have introduced a small downward revision in our projected growth for China in 2024 (from 2.8% in the previous edition to 2.4%). With China contributing almost half of the total manufacturing market’s value and currently propping-up overall growth at a global level, any revision or turbulence in the Chinese market will have a significant impact on the global outlook and could see a small contraction in the MIO compared with 2023.

Green shoots of recovery are being seen in the US economy (often a bellweather for the global manufacturing industry), but this is not the case in Europe. All four major European manufacturing economies are in a downward cycle and the outlook for the year remains gloomy. In fact, during our meetings with companies at Hannover Messe, many referred to weakening order books for the second half of the year. Positive signals in the US are likely to manifest in other parts of the world during the second half of 2024, setting up conditions for the anticipated recovery in 2025.

Sluggish growth continues for manufacturing machinery industry

In response to subscribers’ requests, we have expanded this edition of the MIO to include summary profiles of seven different machinery sectors and we will cover additional segments in future editions. With the exception of the semiconductor & electronics industry, which has already experienced a significant downturn and is now in the recovery phase, our growth projections for the other sectors covered are relatively similar.

The chart below shows forecast growth for the textile machinery sector, illustrating our expectation of a dip in market expansion during 2024, followed by a return to steady growth from 2025 to through to 2028. The profile for 2024 for the top 5 regions reflects what we have heard from machinery suppliers about falling orders and a reluctance at present among customers to invest in new equipment.

For example, we have spoken with one textile machinery company that has witnessed a significant fall in backlog, as it has seen orders fall sharply and has been completing a lot of the work on its books. This is one of many machinery manufacturing businesses across all industry sectors that report similar problems with order intake.

Rather than replacing whole machines, companies appear to be sticking with what they have and choosing to keep them running by replacing parts where needed. This caution around investment in machinery is expected to continue even after the manufacturing industry starts to recover and it is not clear when this wait and see approach will end and manufacturing machinery sales will see an uptick.

Final thoughts…

There are still imponderables when it comes to how and when recovery in global manufacturing – and within the manufacturing machinery segment in particular – will take place. China is experiencing a series of economic challenges and when and how successfully it overcomes these will have a significant bearing on the global outlook. Global political unrest and elections such as the US Presidential Election in November will also have a bearing on outcomes for the manufacturing industry. However, all the signs point to there being a recovery in the not-too-distant future and a growing optimism about it happening in the first half of 2025. This is backed up by our discussions with industry professionals and attendance at international trade shows.

JACK LOUGHNEY, Senior Data Analyst

Jack works as the primary data analyst across multiple research activities. His expertise lies in data modelling, economic forecasting and streamlining processes to enhance product efficiency. Jack is responsible for the upkeep and enrichment of our MIO tracker.

Interact Analysis’ Manufacturing Industry Output (MIO) Tracker forecasts out to 2028 and covers a total of 45 countries, across 72 manufacturing end user sectors, 30 machinery sectors and two points in the supply chain (machinery and manufacturing end-users).